How much can i borrow on a shared ownership mortgage

Shared Ownership mortgages are hard to understand. The rent is generally calculated at 3 of the equity owned by the landlord.

Self Employed Mortgage Calculator Haysto

Before we can buy a place together we need to work out how much you can afford based on your income and outgoings.

. A 0 mortgage where the borrower could borrow up to 25 of the. Total property price Mention the full amount of the property. This is far more attainable than the 10.

You could lose your home if you do not keep up payments on your mortgage. Shared ownership mortgages are designed to assist people getting onto the property ladder who may. Housing providers and local authorities dont make the costs clear.

Shared Ownership Mortgages Finding the mortgage deal that makes a house your home. Shared ownership mortgages could allow you to buy between 25 and 75 of a property with a. Mortgages are secured on your home.

From what weve seen initial rates can vary from 146 to 219 for two. Your deposit age and the loan to value age which together add up to 100 You can now look. The minimum amount of share you can have in a property has reduced from 25 to 10.

A repayment calculator for shared ownership is a calculator that can help you to understand how your monthly repayments will change over time. Theyre also known as part buy part rent mortgages and are offered by housing associations. This would cost you 40000 in total so you might put down a 10 deposit of 4000 and take out a 36000 mortgage for the rest.

On top of this monthly mortgage payment youll also need to. Most shared ownership mortgages will begin with a lower initial rate before moving onto their subsequent rate. Maintenance payments andor childcare costs.

An estimate of your maximum mortgage 2. First you input the propertys total price the. The amount of money you spend upfront to purchase a home.

A 20 down payment is ideal to lower your monthly payment avoid. Under the scheme the cost of home ownership is made more affordable because you can start by buying as little as 25 share in a property and your deposit can be 5 of the price of that share. Advice is often contradictory and.

The decision that the calculator gives you is a guide only and not the. The property prices you should look for 3. Applicants can buy between 25 and 75 of the property and buying a larger share later at a price based on the value of the property at the time is also possible.

The buyer purchases a share of the. Think carefully before securing other debts against your home. Total of service charge and rent.

Total monthly credit commitments - eg. Shared ownership schemes are intended to help people who cannot afford to buy a suitable home in any other way. For the rest of the space you have given a rent to the association and to calculate that shared ownership rent calculator helps.

For example if the property is worth 200000 and the share owned by the leaseholder is 50 the. Clear information tailored to you. You can buy additional shares in 1 instalments instead of the former 5 or 10.

Most home loans require a down payment of at least 3. The shared ownership scheme allows people to buy a share in their home even if they cannot afford a mortgage on the entire value of the property. In a similar way to the Help to Buy scheme shared ownership may only require a small deposit starting from as little as 5 of the price of the share.

Bank loans hire purchase catalogues.

Key Terms To Know In The Homebuying Process Infographic Real Estate With Keeping Current Matters Home Buying Process Home Buying Real Estate Terms

Steps To Buying A House Home Buying Tips Home Buying Buying First Home

What Is Home Equity Wowa Ca

Self Employed Mortgage Calculator Haysto

Pin On Housing Market

How The Super Rich Buy Their Homes Financial Times

Mortgage Down Payment Calculator 2022 Mortgage Rules Wowa Ca

How To Increase The Amount You Can Borrow My Simple Mortgage

Cristina Ferrara On Instagram Mortgage Interest Rates Have Dropped Considerably Over The Past Year Locking A Mortgage Interest Rates Interest Rates Mortgage

First Time Home Buyer In Ontario With Low Income Woodstreet Mortgage

Family Loan Agreements Lending Money To Family Friends

Renting Vs Owning A Home Buying First Home Real Estate Tips Home Buying Tips

First Time Buyer Guide How Much Can I Borrow Moneybox Save And Invest

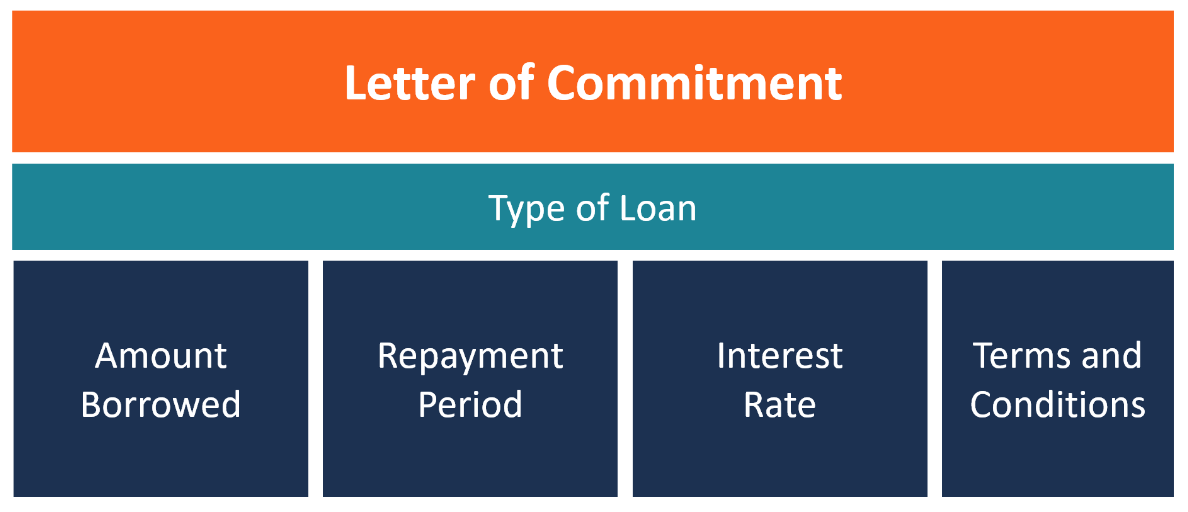

Letter Of Commitment Overview Example And Contents

:max_bytes(150000):strip_icc()/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

Secured Vs Unsecured Lines Of Credit What S The Difference

![]()

Pros And Cons Of Joint Mortgages Loans Canada

How Much Can You Afford To Borrow On A Mortgage Forbes Advisor Uk